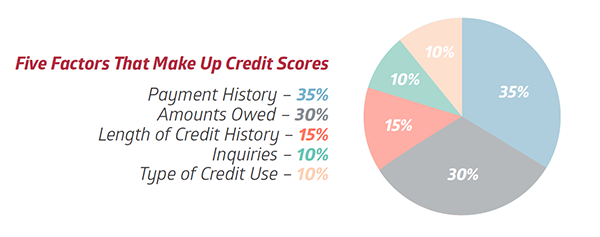

How Credit Scores Are Calculated

When apply for a home loan the lender will undoubtedly check your credit report, which summarizes your credit history. A healthy credit score is the single most important criterion lenders consider when evaluating a borrower’s creditworthiness. A good credit score equips you with negotiating power that you can use effectively to get better interest rates and other benefits. Knowing the factors that go into making your credit score will help you dispute any errors and maintain a healthy score. There is limited, or inaccurate, public knowledge about how credit scores are calculated. To help, we list some important criteria that credit reporting agencies use to calculate credit score.

1. Your Payment History (35%)

Many experts argue that payment history is the most important criterion used when calculating credit scores. The credit reporting company will gather important info such as the number of credit accounts you have, details on the number of credit accounts you have paid, and those that are outstanding, and missed payments. The agency will also take into account the frequency of late payments and your details on public records such as bankruptcy, liens, wage attachment, and foreclosure.

2. Used vs. Available Credit (30%)

When calculating your credit score, the credit reporting agency would want to know how good you are at managing your monthly payments. The company will gather info about the amount of credit you have used out of the available credit on your credit cards. The agency will study other revolving line of credits (a loan that allows you to borrow, repay, and reuse the available line of credit) you use. Further, the credit reporting agency will also collect data about the total amount you owe (as debt).

3. Type of Credit Used (10%)

To evaluate how effective the person is at managing different lines of credit, credit rating agencies collect info about the different types of credit the individual uses. The key to maintaining a healthy credit score is meeting payment obligations that arise due to these lines of credit in-time.

4. Your Credit History Length (15%)

To evaluate how good you are at managing your credit accounts over time, credit agencies gather details about your oldest and the latest credit account. Some important info the credit rating company will look for are the date when these accounts were opened, the period of their operation, how frequently you use them, and whether there are any judgement or public record items listed against these accounts.

5. Credit Report Inquiries (10%)

Whenever you apply for a new loan, you would be required to sign a document that authorizes the lender to request a copy of your credit report from credit reporting agencies. There are two types of credit inquiries - soft inquiries and hard inquiries. Soft inquiries are done by you to check your credit score, by a company offering a promotional offer to you, or by a company that is already offering services to you. Hard inquiries are requested by lenders with whom you have applied for credit. Soft inquiries, in general, do not impact the person’s credit score, it is hard inquiries that pose a problem and can impact the credit score for people with a short credit history or fewer accounts.